There’s an issue going on right now where other government personnel are getting pay hikes over nurses. I do empathize with fellow nurses. It does hurt to be left behind. I am not going to belittle those feelings and feedback, however I also would like to focus on the good news. This year is the start of zero taxes for anyone earning a salary of less than Php 250,000 per annum. So anyone earning less than Php 20,833 per month will have more take home pay compared last year.

Third Tranche of SSL for Nurses

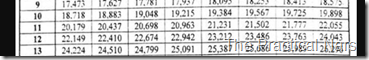

I’m going to focus on the salary grade of government nurses specifically Nurse 1 as the population of Nurse 1 is greater than Nurse 2 to 5 combined. Nurse 1 in the Philippines have a salary grade 11. Looking at the table, we are going to be receiving a salary of Php 20,179 (rounded up).

You can view the whole table here.

New vs Old Taxes

The Dept. of Finance (DOF) provided a neat calculator in a website for anyone who wants to check their taxes. The calculator only calculates salary tax. Which means your salary should only have the tax shown to be deducted. The system is a whole lot simpler and provides a breakdown. As shown below, if you plugged in the numbers for salary grade 11 earners, no tax is deducted.

The total contribution of Php 2,193.57 comes from the GSIS, Philhealth and Pagibig contributions. Though I do have to question it a bit. Because GSIS has been deducting me almost 3k pesos for contribution alone (I know that loan deduction is different). So anyone with a salary of less than Php 20,800 will have no tax deductions and it won’t matter if you’re married, have dependents or working in private and government institutions.

The website has a small Q&A and a disclaimer that says that other income like benefits are not included in the calculator. You might need a trip to BIR to ask how you’re going to be taxed if you’re going to receive 13th and 14th month, bonuses and more.

Test the http://www.taxcalculator.ph/ right here

Companies and government institutions might have problems implementing this because it’s a new procedure. If they make mistakes, you can inform your superiors and go through proper channels to correct the mistakes. If they do insist on using old tax rates, you can inform the respective government offices. It’s DOLE for private institutions and Civil Service for government institutions.

Once again, HAPPY NEW YEAR NURSES!

Be positive, be practical!

No comments:

Post a Comment